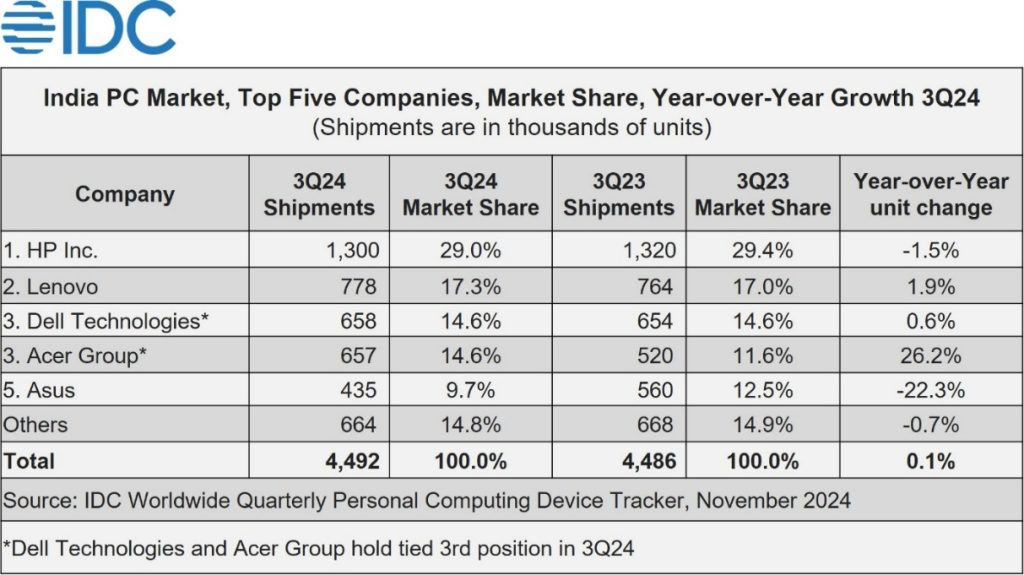

In keeping with IDC’s quarterly Private Computing System Tracker, India’s conventional PC market, which incorporates desktops, notebooks, and workstations, recorded shipments of 4.49 million items in Q3 2024, up year-on-year (YoY). exhibiting a modest development of 0.1%. This comes after 7.1% annual development in Q2 2024.

Whereas desktops declined by 8.1% YoY, notebooks and workstations confirmed modest features of two.8% and a couple of.4% YoY, respectively. Particularly, gross sales of premium notebooks (priced above $1,000) rose 7.6% year-over-year, pushed by festive on-line promotions.

Client and Industrial segments

The buyer section skilled a year-on-year decline of two.9% regardless of aggressive low cost provides by distributors on on-line platforms. Not like Q3 2023, demand remained natural, as distributors averted overstocking in Q3 2024, which helped restrict losses.

In distinction, the business section grew by 4.4% YoY, pushed by a 9.6% YoY development in enterprise demand. In keeping with Bharat Shenoy, analysis supervisor for IDC India and South Asia, early e-tail gross sales that began in late September boosted PC shipments.

Shenoy famous that manufacturers took benefit of those gross sales by providing reductions, cash-back provides, and bundled equipment, whereas matching costs throughout all bodily shops. This technique has resulted in one of many strongest buyer base on file.

Main manufacturers in Q3 2024

- HP Inc. led the market with a 29% share, dominating each the business and client segments with a share of 34.3% and 24.8% respectively. HP’s success was because of enterprise demand, which grew 30.2% year-on-year, and robust gross sales of client notebooks through the festive season. The corporate shipped 1.05 million notebooks, its third-best quarter ever.

- Lenovo is second with 17.3% market share. Vital enterprise orders and momentum within the SMB sector helped it acquire 20.3% share within the business market. Lenovo’s client section grew 3% YoY, boosted by branded gaming notebooks and e-tail promotions.

- Dell Applied sciences carried out effectively within the SMB sector, gaining 14.6% share, the place it grew 14.9% year-on-year. It gained 20.8% share within the commerce market however noticed a 5.4% decline in client share because of restricted participation in e-tail promotions.

- Acer is tied with Dell, which additionally has a 14.6 p.c share. Acer’s shipments grew 26.2% year-on-year, pushed by partial success of training initiatives and enterprise orders. It led the business desktop market with a 30.2% share and noticed a 38% year-over-year improve in client shipments through the festive gross sales.

- Asus is in fifth place with 9.7% share. A lean stock resulted in a 22.3% YoY decline. Nevertheless, Asus gained a 16.2% share of the buyer market, second solely to HP, and the business section grew 5.5% year-on-year.

Outlook for the longer term

Nakendra Singh, affiliate vp of gadgets analysis at IDC India, South Asia and ANZ, stated the business PC market is recovering as enterprises regularly refresh their IT tools. He stated that IT/ITES sector purchases are anticipated to speed up in 2025.

Singh additionally highlighted that growing demand for PCs in gaming and content material creation, together with growing deal with AI-powered options, will drive client demand in This autumn 2024 and 2025.

…………………………………………

DYNAMIC ONLINE STORE

A complimentary subscription to remain knowledgeable in regards to the newest developments in.

DYNAMICONLINESTORE.COM

Leave a Reply