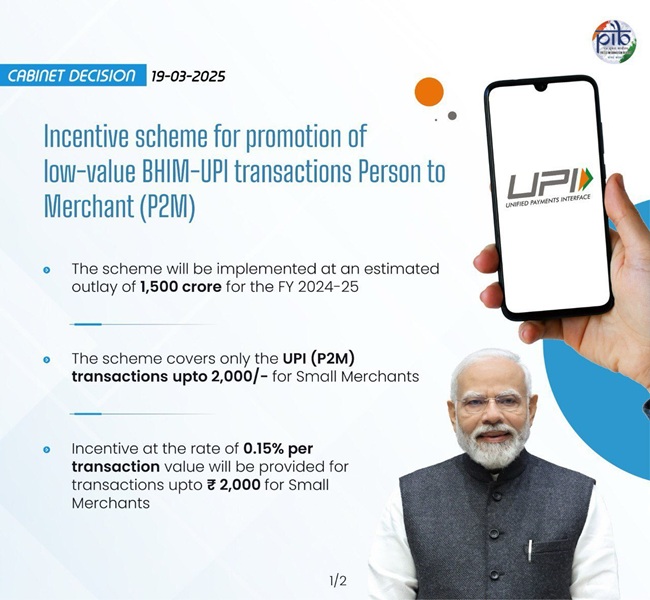

The central cupboard, chaired by Prime Minister Narendra Modi, has accredited an inspirational scheme to advertise low-cost Bhim-UPI transactions (Service provider-P2M) for the monetary 12 months of 2024-25. The press launch states that it goals to extend digital funds, which can concentrate on small businessmen and indigenous Bheem -up platforms.

- Timeline: 1st April, 2024, 31 March, 2025

- Funds: RS. 1,500 crores

- Goal: UPI P2M Transaction RS. 2,000 for small merchants

Options and funds of the scheme

The discharge states that the transfer has eradicated the service provider low cost fee (MDR) to supply particular transactions and privileges. It’s designed to cut back the prices of small merchants, whereas encourages banks to keep up dependable system.

- Scripture: Solely solely small merchants covers the transaction of Rs. 2,000

- Directions: 0.15 % per transaction worth for small merchants

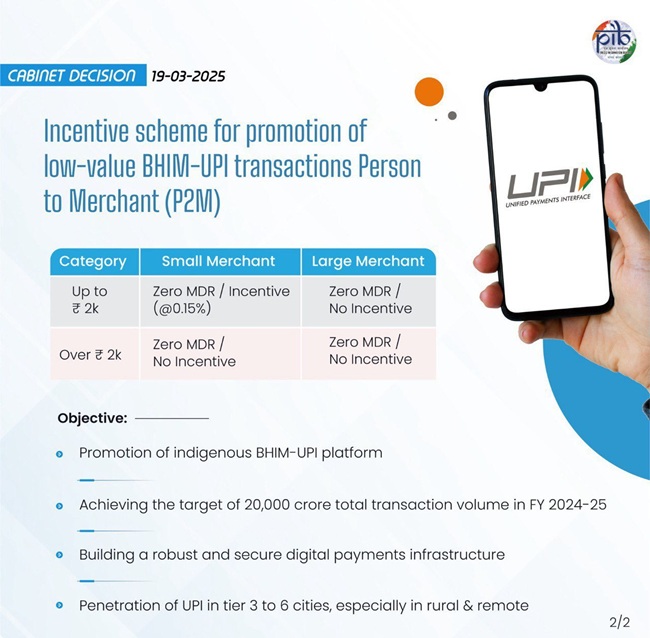

MDR and Terrorism Error:

- Small retailers:

- Zero MDR + 0.15 % of the journey (for transactions as much as Rs 2,000)

- Zero MDR, no incentive (for greater than Rs 2,000 for transactions)

- Massive merchandise:

- Zero MDR, no incentive (in every amount)

Fee construction:

- 80 % of the accredited claims pay in entrance of a phrases

- 20 % Situation:

- 10 % If the technical discount stays lower than 0.75 %

- 10 % If the system up time exceeds 99.5 %

Advantages for shoppers and merchants

The cupboard highlighted the advantages of clean funds and low money economic system, which emphasised facility and value saving.

- Residents: Quick, secure cost with out additional compensation

- Small retailers: Free UPI entry, in addition to Medicare to undertake digital funds

- Added Services: Acute money movement for credit score entry, digital footprints

- Advantages of System: By making certain 24/7 service, banks have been rewarded for prime -up -time and low technical shortages.

Plan’s targets

The scheme decided the daring targets, including within the launch, which goals to extend UPI entry and strengthen the cost infrastructure.

- The aim of transactions: 20,000 million complete quantity in 2024-25

- Hump-Upi Foxes: Promote the homegone platform

- Rural extension:

- Improve the usage of UPI in tire 3-6 cities and distant areas

- UPI123 Pay (Characteristic Telephone Transactions) and UPI Mild/Lightx (Offline Fee)

- Financial institution requirements:

- Preserve excessive -up time (over 99.5 %)

- Preserve the technical fall beneath 0.75 %

- Monetary stability: UPI whereas minimizing authorities spending

Background and Date of Funding

Selling digital funds is central to the federal government’s monetary inclusion technique, which presents various powers. Typically, MDR – Debit Playing cards (RBI) reduces trade prices as much as 0.90 % or 0.30 % for UPIP 2M (NPCI).

Since January 2020, the Funds and Settlement System Act, 2007 Modification, and the Revenue Tax Act, Part 269SU of 1961, made MDR zero for debit playing cards and Bhimupi.

Previous Media (₹ Crore):

- Fiscal Yr 2021-22: RS. 1,389 (rupees: 432, Bhim Api: 957)

- Fiscal Yr 2022-23: RS. 2,210 (Rs. 408, Bhim UP: 1,802)

- Fiscal Yr 2023-24: RS. 3,631 (Rs. 363, Bhim Api: 3,268)

Fee movement: Authorities funds receiving banks, that are collaborating in banks, cost service suppliers, and app supplier (TPAPs).

The discharge states that the scheme relies on the inheritance, which gives the cost system to supply sturdy, safe digital infrastructure.

…………………………………………

DYNAMIC ONLINE STORE

A complimentary subscription to remain knowledgeable in regards to the newest developments in.

DYNAMICONLINESTORE.COM

Leave a Reply